Market Update: Ocean Freight & Tariffs (as of June 4)

A) Ocean Freight Market Overview

The market is showing signs of stabilizing.

Asia–U.S. Rates: After spiking, rates are now easing as carriers have added more capacity than demand supports—especially through Los Angeles/Long Beach.

Space Availability: There is more space on PSW (Pacific Southwest) routes, while PNW and East Coastremain tight.

Rate Increases Slowing: With space opening up, carriers are unlikely to push more mid-June increases and are now trying to hold gains made on June 1.

Stalled Surge: No container shortages and manageable port congestion have slowed the recent rate climb. The SCFI index may begin dropping after 4 weeks of increases.

JMC Global Insight:

We’re monitoring vessel adjustments and capacity shifts closely to help our clients plan confidently in a changing market.

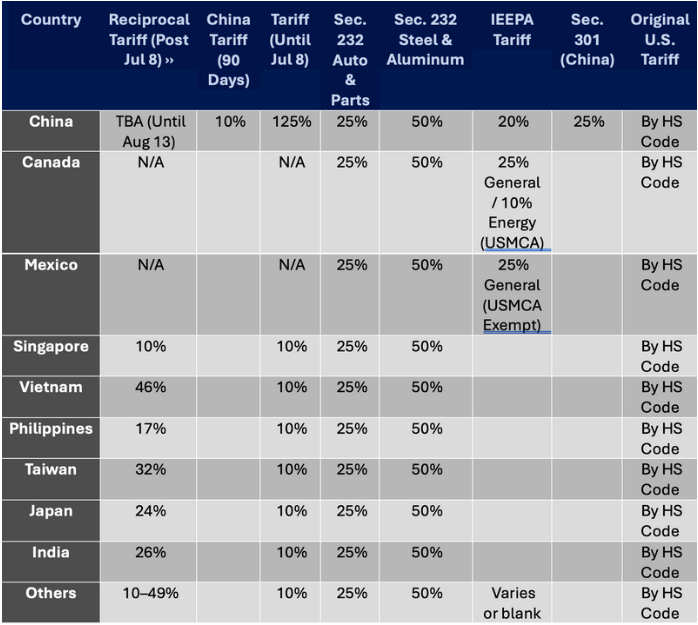

B) Tariff Update: Section 232 Steel & Aluminum

New Tariff Rate: Starting June 4, 2025, the tariff on steel and aluminum imports doubles from 25% to 50%.

UK Exception: Still 25% for now, but subject to change after July 9, depending on the U.S.–UK Economic Prosperity Deal.

Scope: Only the steel/aluminum portion of goods is affected; other materials follow different tariffs.

When Does It Apply?

If arrival or entry happens on/after June 4, the 50% tariff applies.

For Inland Transfer (IT) entries, the first U.S. landing date determines the tariff.